Conditions for accessing the DV Visa

Entry into and residence in Italy of non EU citizens who meet the definition of digital nomad and who:

- possess the minimum education qualifications as set out in Article 27-quater, paragraph 1, of Legislative Decree No. 286 of 25 July 1998 (see below) and who present evidence of the same;

- have a clean criminal criminal record and present the necessary certification issued by the authorities in their country of residence (e.g ACROfor the UK );

- have a minimum annual income from lawful sources that is not less than three times the minimum level laid down for exemption from participation in health expenditure -i.e. approximately Euro 28,000 annually for singles – higher amounts apply to family units

- have health insurance for medical treatment and hospitalisation valid for Italian territory and for the period of stay;

- have appropriate documentation concerning accommodation arrangements in Italy;

- can demonstrate previous experience of at least six months in the context of the work activity to be carried out from Italy;

- present the contract of employment or collaboration or a related binding offer, if they are a remote worker, who, for the performance of a work activity is required to possess of one of the requirements set out in Article 27-quater, paragraph 1, of Legislative Decree No. 286 of 25 July 1998 (see below);

- works or is to work for an Italian employer who presents a declaration signed by the employer, accompanied by a copy of a valid identity document attesting to the absence of any criminal convictions, in the past five years, for Immigration offences referred to in Article 22, paragraph 5-bis, of the Immigration Code.

Evidence of the meeting the requirements will need to be presented, when applying for the Visa at the competent diplomatic-consular office. What various consular offices will require in this context remains to be seen but applicants should focus on attending the consular appointment with

- an original copy of a degree certificate;

- a copy of a Dichiarazione di Valore (certification issued by an Italian Consular authority attesting to the validity of the certificate of you degree of your educational qualifications i.e. that the institution and course(s) followed are bona fide – or in other words that your degree was not issued by a “degree mill”;

- criminal record certificate;

- proof of income (recent payslips, annual certification of earnings, tax return, recent bank statements);

- receipt for health insurance and copy of the contract;

- proof of accommodation arrangements in Italy – signed rental contract or copy of home purchase document;

- evidence of prior six months working as remote worker;

- offer or contract of employment in Italy, contract for services or other evidence of future source of income;

- self certification signed by or on behalf of the prospective employer in Italy, if you will be working for an Italian employer, certifying the absence of criminal convictions in the past five years.

Practice varies from consulate to consulate in terms of exactly what is required, and also in terms of translation of documents not in the Italian language and requirement for he affixing of an Apostille to applicable documents.

Applicants will be well advised to seek the services of an attorney or other counsel familiar with the procedures of the Italian Consular Service to assist collating the appropriate documents minimising the need for repeat appointments and the risk of the documents ceasing to be valid due to the passing of time. It is hoped that Italian consulates will publish a detailed listing of requirements for the issue of the DN Visa is due course.

Procedure

The Request for a Visa needs to be presented at the Italian consulate for the jurisdiction in which you currently reside along with supporting documentation. The Consular Authorities will be responsible for the issue of an Italian fiscal code number.

Once the Visa is issued you can enter Italy and within 8 days of arrival you need to present to the Police Immigration Service for the jurisdiction in which you reside, a request for the issue of a Stay Permit (Permesso di Soggiorno). The application needs to be made online using a kit available from Italian Post Offices. You will be given an appointment to attend your local Police Immigration Service Offices (Questura) to check your ID, the relevant supporting documents, and for your fingerprints to be taken. You will be called back later to the Questura to collect your stay permit card when it is ready.

A request for renewal of the stay permit will need to presented within 60 days before the first year of expiry, if you want to stay and continue to meet the conditions for issue.

By Colin Jamieson

On 4 April 2024 a Ministerial Decree issued by the Italian Interior Minister was published in the Italian Official Gazette. Effective 5 April 2024, the Decree implements the Digital Nomad Visa and Stay Permit envisaged by a 2022 Law amending the Italian Immigration Code and introducing the Digital Nomad Visa for the first time into Italian law.

Outline

Italy has introduced new rules to allow certain non-EU citizens who are “digital nomads” entry into Italy to live and work remotely.

An amendment to the Law converting Decree-Law n. 4/2022 (Sostegni ter) legally defines who is to be considered a digital nomad as a worker from a country outside the European Union who perform “highly professional and digital” tasks.

An entry visa obtainable via an Italian consulate in the country of origin will therefore be sufficient to enter the country. This will allow individuals to come to and work in Italy on condition that on arrival they request a stay permit (“permesso di soggiorno“) and that they meet the conditions set out below. The stay permit can be renewed and extended after the initial one year period provided the conditions continue to be met.

Digital nomads will in any case be obliged to comply with all tax and social security provisions. Given that Italy has a couple of favourable tax regimes (see below) for new arrivers, this should not be an overly onerous condition (as regards the tax anyway) as long as new arrivers take advice prior to moving on the timing of the move, check the conditions for the relief, and properly forecast in advance the timing of tax/social security payments.

These new rules will allow non EU citizens to work remotely without needing to apply for one of the (few) working stay permits under the usual annual quotas set by the annual “Decreto Flussi” (pursuant to Legislative Decree No. 286 of 1998 – Consolidated Immigration Code) or otehr form of visa(stay permit which generally require sponsorship by an Italian employer or investment.

Who is a digital nomad?

The definition of a digital nomad is as follows:

“Citizens of a third country, who carry out highly qualified work activities through the use of technological tools that allow them to work remotely on a self-employed basis or for a business, including those not resident in the territory of the Italian State.”

It is therefore a rather wide definition which covers both the self-employed and individuals who a work under a contract of employment, either for an employer/client based in Italy or based outside the country. The new category refers to workers who carry out an activity requiring professional/technical skills remotely. For example, web programmers, digital marketing specialists, writers and bloggers or even translators and graphic designers. It does not therefore include manual workers or people who jobs require them to be mainly physically present at their employer’s premises when they are carrying out their activities.

Entry into force

The Ministerial Decree states that the digital nomad rules enter into force from 5 April 2024 and covers implementation matters such as:

- the procedures and detailed requirements for issie of the stay permit (including the categories of highly qualified workers who can benefit from it);

- the minimum income thresholds for applicants/family units;

- the procedures for checking the work activities carried on by applicants and compliance fall within the definition of “digital nomad”;

- procedures for the new stay permit renewal process, evidence of compliance with tax, healthcare and social security requirements;

- other pre-requisites

WHO CAN MAKE AN ITALIAN WILL?

A person who is

- at least 18 years old;

- the legal owner of the assets;

- of sound mind (capace di intendere e di volere). In the event of a dispute over the mental capacity at the time of drafting the will, a court will decide.

WHO SHOULD MAKE AN ITALIAN WILL?……

Although, in general, Italy will recognise as valid an International will, it is generally recommended that a foreigner makes a will in Italy if they are living permanently in Italy, especially if they expect to maintain that status until the time of their death if they own immovable property (house, apartment land) in Italy.

The main reason for making an Italian will is to simplify the administration of the estate after death.

If your assets are all in Italy then it will ease the administration of the estate if you prepare a will under Italian law. If you have assets also outside Italy, it will generally ease the administration in each country to have two wills one for each country. It is important that, in order to avoid the potential for conflict, the two acknowledge the presence of the other (or at least are stated to deal only with the property in each jurisdiction.) However each case needs to be examined individually.

………AND WHY?

Heirs of a will drawn up under foreign law may have substantial difficulty in dealing with the transfer of any Italian assets. This is because the will must be authenticated before an Italian Notary Public.

The Notary, or any other Italian Professional will need to examine the foreign will with regard to the Italian assets, resolve any conflicts between foreign and Italian law, as well as advising heirs and/or preparing suitable documentation to transfer the assets. Foreign wills tend to be complicated by the setting up of trusts, reference to foreign statute and third party regulations (such as the estate management rules published by associations of trust and estate practitioners.

The costs of translation of all documents in the English language into Italian may be steep and may well be more than the cost of making an Italian will.

In terms of inheritance tax a will under foreign law may well keep you within the inheritance tax of the foreign country. Italian inheritance tax rates and thresholds are typically more generous than in other countries (see INHERITANCE TAX CHAPTER). This in practice means that the small / medium Estates are not subject to Inheritance tax in Italy.

IS A WILL NECESSARY AT ALL?

According to Article 457 of the Civil Code, inheritance is devolved by law or by will. If there is no will, the Italian Civil Code sets out who is entitled to the estate in a specific order based on the degree of kinship with the deceased. Under these rules the estate devolves to the spouse, descendants, ascendants, collaterals (siblings), other relatives and the State, in the order and according to the rules established by law.

CAN I MAKE A WILL UNDER ITALIAN LAW LEAVING THE PROPERTY TO ANYONE I LIKE?

The answer to this is fundamentally “yes” except that certain heirs are entitled by law to take a share of the estate in certain circumstances and will thus have the right to challenge the inheritance, if their rights under Italian law have not been respected. These rules do however allow someone to freely dispose of a set part of their estate – this is called the freely devolvable share. Leaving your estate by to someone other than a legitimate beneficiary above the limit of the freely devolvable share, means that there is a risk that the legitimate can challenge, seeking either financial compensation or indeed that the transfer of an asset comprised in the estate to a non legitimate beneficiary in the will is set aside.

WHAT ARE THE DIFFERENT WAYS OF MAKING A WILL?

Under Italian law there are three different ways of making a valid Will:

-

Handwritten Will (Holographic will – Testamento Olografo)

This document:

- is personally handwritten by the person making the Will (Testator),

- is dated (the most recent will in the event of several wills executed over time will generally be the valid will

- can be in any language, written on any paper / other medium.

Although it is a simple document, it is advisable that it should be checked by a lawyer to ensure that all the formal and substantive legal requirements have been satisfied.

-

Formal Will (Testamento Pubblico)

This document

- is drafted by an Italian notary upon the instructions of the Testator,

- is read out by the Notary to ensure that it complies with the wishes of the Testator,

- is signed by the Testator in the presence of witnesses,

- is lodged with the Italian notary. As a formal document ,and will not be lost / disregarded.

- involves a cost (notarial fees);

- can be disclosed to a third party, because it is public will, not secret.

-

Secret Will (Testamento Segreto)

This is a Will drafted/written by the Testator and placed in a sealed envelope which is then delivered to an Italian Notary. The notarial fees are reduced. The contents of the Will remain secret until after the death of the Testator when the sealed envelope will be open.

WHAT IS THE ACTUAL PROCESS OF MAKING A WILL?

In the case of

1.Handwritten Will (Holographic will – Testamento Olografo

There is no need of witnesses, there is no attestation clause. It can be a very simple letter or document drafted directly by the testator.

- Formal will (testamento pubblico)

It is necessary to have an appointment by the notary and explain the will of making a “testamento pubblico”, giving the relating instructions. Not all Italian Notaries speaks English, so it better to find out one English speaking. Generally the witnesses requested are elected by the notary between his clerks.

-

Secret will (testamento segreto)

As para 2 above – see above

It is better to have legal advise by a lawyer dealing with the two jurisdictions. Wills and probate matters involve taxation issues. For complex estates or where there are cross border aspects it is generally better to seek assistance from an Italian lawyer for the preparation of the will. the lawyer will be able to introduce and coordinate other professionals (notary, accountant, geometra) as necessary.

If you have chosen to make a Testamento pubblico, the Notary Public will be able to draft the will according your instructions. Not all Notaries are able to dealing with two or more jurisdictions, as the Testamento Pubblico involves only Italian legislation.

HOW LONG DOES IT TAKE?

It is not a lengthy procedure, It is important to prepare all documents accurately. Contact an Italian professional (lawyer or Notaio) with a clear outline of what you want the will to contain, names and addresses of beneficiaries and specific legacies, Avoid changing your mind, if possible, as this will introduce extra expense – you can always change your will up to the time of death, if you remain of sound mind, but if you are in good health why drive make the notary or the lawyer crazy changing your intentions a few minutes after drafting the will)

In case of emergency you can write your will directly or contact a Notary who can receive your last will.

WHAT HAPPENS AFTER THE DEATH OF THE WILL-MAKER?

Firstly, the heirs (or one of them) or administrators/executors, if appointed by the will, must ascertain what kind of will the testator made, or proceed on the basis of the statutory rules dividing the estate in the absence of a will..

You must collect all the documents affecting the testator’s properties and contact an Italian professional (Lawyer, Notaio, Accountant or Geometra) to make the “Dichiarazione di successione”.

The “dichiarazione di successione” must be made by the heirs within 12 months from the date of death. Penalties for late presentation apply ragning from Euro 150 if no tax is due up to 120% of any tax due. The Declaration involves the completion of a form in which all the assets must be shown with the relevant values (as calculated under inheritance tax rules). The form should be filed (generally online) with the appropriate Tax Agency office. This will be the area office covering the municipality, the town where the deceased was resident at the time of death. If the deceased was not resident in Italy, the declaration of succession must be presented to the relevant Tax Office in Rome.

Finally, the Notary will be able to complete the procedure by registering the transfer of any real estate into the names of the new owners at the Land Registry (Catasto). Registration taxes will apply, calculated on the value of the assets as well as stamp duties and notarial fees.

ITALIAN INHERITANCE TAX

The heirs (or administrators) of the Estate will be requested to pay any Inheritance Tax due when they present the Declaration of Succession to the competent office.

Italian Inheritance Tax is currently levied at three different flat rates, by reference to the entitlement under the will or succession, as follows:

- 4% where the Estate or part of the Estate devolves to the Deceased’s spouse or children, with a nil rate band up to a maximum of € 1,000,000 (the “Franchigia”) each for the spouse and each of the children;

- Where all or part of the Estate or part of the Estate devolves to one or more disabled children, the Franchigia is increased to Euro 1,500,000 (£ 986,800 at the current rate of exchange);

- 6% where the Estate or part of the Estate devolves to brothers or sisters (subject to an exempt Francogia of Euro 100,000 each);

- 6% where all or any part of the estate devolves to other relatives of the Deceased up to the 4th degree (without any “Franchigia”);

- 8% where all or part of the Estate devolves to unrelated parties.

The basis for the inheritance is subject to a number of rules. The calculation of the taxable involves taking the value of all the assets of the deceased and subtracting any liabilities (debts) and medical expenses (up to a little over Euro 1,000) paid in the six months before death.

Not all assets need to be included. Those that may be excluded are:

government securities,

certain debt claims against the State that have not yet been recognised as subsisting by order of the debtor public entity;

claims asserted in a court of law but not yet defined by a court judgment;

movable property registered in the Public Register of Motor Vehicles;

severance pay and employment benefits;

cultural assets subject to a restriction such as assets of architectural, historical or cultural value.

certain interests in companies, businesses in favour of spouses and heirs in the direct line

certain life insurance payments on death

Where the heir is an ecclesiastical or religious entity, or Italian charity (onlus) no inheritance tax is due.

GUIDA PRATICA E TO DO LIST

ITALIA

Che cosa è la dichiarazione di successione e chi è tenuto a presentarla?

La dichiarazione di successione è un adempimento obbligatorio, di natura prevalentemente fiscale, attraverso il quale viene comunicato all’Agenzia delle Entrate il subentro degli eredi nel patrimonio del defunto, e vengono così determinate le imposte dovute, sulla base del quadro normativo in vigore. Sono tenuti a presentare la dichiarazione di successione gli eredi, i legatari ed i loro rappresentanti, nonché gli immessi nel possesso dei beni ereditari, gli amministratori dell’eredità, i curatori dell’eredità giacente e gli esecutori testamentari.Entro quanto presentare la dichiarazione di successioneLa dichiarazione di successione deve essere presentata entro 12 mesi dalla data di apertura della successione che, di norma, coincide con il momento del decesso del de cuius. Se presentata successivamente, espone chi è tenuto a sanzioni di carattere amministrativo che aumentano all’aumentare del ritardo.

Dove presentare la dichiarazione di successione

Da predisporre su apposito modello a disposizione presso l’Agenzia delle entrate, la dichiarazione deve essere presentata presso l’Ufficio delle Entrate nella cui circoscrizione era fissata l’ultima residenza (domicilio fiscale) nel caso in cui il de cuius fosse residente in Italia.Nel caso in vece in cui il defunto fosse residente all’estero, la dichiarazione di successione andrà presentata presso l’Ufficio dell’Agenzia delle Entrate nella cui circoscrizione era stata fissata l’ultima residenza italiana. Se però non è nota l’ultima residenza italiana, la dichiarazione è da inoltrarsi presso l’Ufficio dell’Agenzia delle Entrate di Roma 6.

Quale è la base imponibile nella dichiarazione di successione?

La base imponibile nella dichiarazione di successione – ovvero il valore netto dell’asse ereditario su cui verranno calcolate le imposte di successione – è determinata quale differenziale tra l’importo complessivo dei beni e dei diritti che rappresentano l’attivo dell’asse ereditario, e l’importo complessivo delle passività e degli oneri deducibili (si pensi, tra i principali, ai debiti personali del defunto).

Quali sono le imposte di successione

Una volta calcolata la base imponibile, si può procedere ad applicare sulla stessa le imposte di successione, con le aliquote che saranno a loro volta stabilite sulla base del rapporto di parentela che intercorre tra il dante causa e l’avente causa.

In maggior dettaglio, le imposte sono pari al:

• 4% nei confronti del coniuge e dei parenti in linea retta (presente una franchigia di 1 mln euro per ciascun beneficiario);

• 6% nei confronti degli altri parenti fino al quarto grado e degli affini in linea retta, nonché degli affini in linea collaterale fino al terzo grado (presente una franchigia di 100 mgl euro per ciascun fratello o sorella);

• 8% nei confronti degli altri soggetti.

Quali documenti bisogna presentare per la dichiarazione di successione

Per poter proficuamente predisporre e inoltrare la dichiarazione di successione sono necessari una serie di documenti da predisporre con particolare attenzione, al fine di non pregiudicare l’efficacia dell’intera procedura.

Riepiloghiamo in tal senso:

• certificato di morte in carta libera per uso dichiarazione di successione;

• Un’autocertificazione sullo stato di famiglia storico;

• fotocopia di un documento di identità in corso di validità di tutti gli eredi;

• fotocopia del tesserino del codice fiscale o della tessera sanitaria regionale del de cuius e di tutti gli eredi;

• atti di provenienza delle proprietà immobiliari intestate al deceduto e/o cointestate con altri soggetti;• atti di donazione che il defunto ha stipulato in vita in favore di uno o più eredi;

• documenti tecnici sugli immobili intestati al deceduto (planimetrie catastali, elaborati planimetrici, mappale, copie accatastamenti DOCFA, eventuali variazioni successive);

• 2 copie autentiche della pubblicazione dell’eventuale testamento;

• copia autentica del verbale di eventuale rinuncia all’eredità;

• fattura dell’avvenuto pagamento delle spese funebri e delle spese mediche;• dichiarazione bancaria / postale di sussistenza e consistenza di mutui ipotecari, conti correnti, libretti, investimenti finanziari, gestioni patrimoniali, fondi comuni di investimento, azioni, obbligazioni, certificati di deposito bancari, pronti conto termine;

• attestato con eventuali ratei di invalidità civile maturati e non riscossi dal defunto;

• dichiarazione del datore di lavoro con indicate le indennità maturate dal lavoratore dipendente (es. mensilità, 13ma, 14ma, TFR, ferie, ecc.);

• dichiarazione societaria di titolarità di quote e valorizzazione delle stesse (sottoscritta dal commercialista);

• verbale di apertura delle cassette di sicurezza, redatto da un funzionario dell’Agenzia

TASSAZIONE

Avendo distinto i due estate e i due wills, non dovrebbero esserci problematiche per quanto riguarda la tassazione; Italia e Usa hanno comunque stipulato un trattato volto ad evitare la doppia imposizione, per cui la tassa di successione pagata in uno stato non può essere pagata doppiamente nell’altro stato.In Italia ad oggi sussiste una no tax area fino ad un milione di euro, come potete vedere come già sopra evidenziato le aliquote dell’imposta sono del 4% per il coniuge e del 6 % per i fratelli e sorelle.Vi segnalo solamente la questione della tassazione dei fondi pensionistici USA in Italia (non strettamente rientranti nella successione) e le varie questioni che si sono affrontate al riguardo.

Nella sostanza, sebbene valga il principio della esenzione fiscale per le rendite pensionistiche, i fondi pensione americani, per il fisco italiano, assumono connotazioni di veri prodotti finanziari e quindi ipoteticamente come tali tassabili. Occorre comunque analizzare la situazione con riferimento ai singoli prodotti.

U.S.A

Death Certificate

Formal proof of death is required; the standard proof is a certified death certificate. If the death happened outside the U.s., the certificate of death has to be legalized. An international certificate of death issued according Wien Convention is often released by the town hall in Italy. I had cases in U.s. where the bank required an official translation with apostille certificate.

Where can I find the will?

the will may be filed with a clerk of court. A decedent’s will becomes a public record when it is filed, after the decedent’s death, with the clerk of court. Any person may view a public record or request a copy of a public record for a fee.

Does the law require a meeting for the reading of the will?

No. U.S.A. law does not require a formal reading of the will.

Locate and identify assets

It is important to take steps to locate and identify assets Keep in mind, however, that a letter of authority from a clerk of court is often required to access information regarding a decedent’s assets.

Where should the estate be administered?

The estate of a U.S. State resident may be administered in the county where he or she was domiciled at the time of death. If a decedent was not domiciled in U.S.A at the time of death, the estate may be administered in any county in which the decedent left any property or assets or into which any property or assets belonging to the estate may have come.

What are “letters testamentary” or “letters of administration”?

Letters testamentary and letters of administration are legal documents issued by the clerk of court that give a person authority to serve as the personal representative of the estate. These “letters” will often be requested by institutions such as banks or insurance companies during estate administration. There are generally two basic types of letters, based on whether the estate is testate (with a will) or intestate (without a will). Testate letters are called “Letters Testamentary” and are granted to an Executor. Intestate letters are called “Letters of Administration” and are granted to an Administrator.

Who may be granted letters testamentary or letters of administration?

Some persons by law are not qualified to serve as a personal representative of a decedent’s estate. In addition, the law gives some persons priority rights to serve as a personal representative. If there is a valid will, an executor named in the will has the highest priority to receive letters. If the executor does not qualify, then a substitute or successor executor named in the will has the next highest priority. If the will does not name a substitute or successor executor or if the decedent did not leave a valid will, then those who may be granted letters are, in the following order of priority:

(1) the surviving spouse,

(2) anyone receiving property under the will,

(3) anyone who would receive property if there was no will,

(4) any next of kin,

(5) creditors of the decedent,

(6) anyone of good character living in the county.

What is a personal representative’s bond and how much is the bond?

Out-of-state executors generally must pay a bond to the court to protect creditors and heirs from potential losses. Administrators must pay a bond unless exceptions apply.Administration ProcessI have been issued letters and opened the estate. Now what?A summary of the procedures for executors, administrators, collectors by affidavit, and persons using summary administration is found at https://www.nccourts.gov/documents/forms/estate-procedures-for-executors-administrators-collectors-by-affidavit-and-summary-administrationEven if not strictly necessary, it is advisable to appoint a professional (lawyer and/or accountant) to help you in all the procedures of administration.

Avv. Carlo Bottino

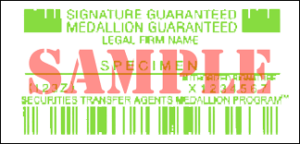

MEDALLION GUARANTEE SIGNATURE: COS’È?

Il Medallion Guarantee Signature (Timbro di Garanzia Medallion) è una modalità di certificazione di firma privata utilizzata prevalentemente quando un cliente trasferisce o vende titoli statunitensi. In particolare, per coloro che vivono al di fuori degli Stati Uniti e detengono azioni in una società quotata statunitense o canadese, l’unico modo per vendere le azioni o trasferire la proprietà in capo a un altro soggetto è di inviare una richiesta di trasferimento recante il Timbro di Garanzia Medallion, unitamente ai vari documenti richiesti.

POSSO RICHIEDERE IL TIMBRO DI GARANZIA IN AMBASCIATA?

No, le ambasciate non forniscono Timbri di Garanzia Medallion, né li riconoscono, poiché la loro validità è limitata al circuito interno bancario.

PERCHÉ MI VIENE RICHIESTO IL TIMBRO DI GARANZIA MEDALLION?

Tramite l’apposizione del Timbro di Garanzia Medallion sul modulo con il quale viene effettuata la richiesta di trasferimento dei titoli, l’istituto finanziario garantisce l’autenticità della firma apposta su tale modulo e si assume la responsabilità per eventuali contraffazioni. Tale procedura tutela gli azionisti, prevenendo trasferimenti non autorizzati e potenziali perdite degli investitori, limitando inoltre la responsabilità dell’agente di trasferimento che riceve i certificati.

TUTTI I TIMBRI DI GARANZIA MEDALLION SONO UGUALI?

Non tutti i Timbri di Garanzia Medallion hanno lo stesso valore. Ad ogni timbro viene assegnato uno speciale prefisso codificato, che determina il valore monetario che può essere garantito. Ad esempio, se il Timbro di Garanzia Medallion è richiesto per un valore di $ 400.000, è richiesto almeno un prefisso C, che è valido per un valore fino a $ 500.000. Se, in via ipotetica, fosse apposto un timbro recante il prefisso D, la transazione verrebbe rifiutata, giacché un timbro D è valido solo per una transazione di valore pari o inferiore a $ 250.000.

A CHI POSSO RIVOLGERMI PER OTTENERE UN TIMBRO DI GARANZIA MEDALLION?

Nel Regno Unito vi sono alcune società autorizzate a rilasciare il Timbro di Garanzia Medallion, solo previo accertamento dell’osservanza di tutti i criteri da parte del richiedente. I requisiti della documentazione da presentare possono variare a seconda delle istituzioni finanziarie che forniscono il servizio.

Sarà necessario fornire all’istituzione finanziaria incaricata alcuni documenti legali al fine di consentire la verifica dell’identità del richiedente e dimostrarne il diritto di proprietà e la capacità di agire, unitamente al certificato di morte e al prospetto del valore attuale delle azioni.

POSSO RICHIEDERE IL MEDAILLON GUARANTEE DALL’ITALIA?

Il nostro network è in grado di seguire tutte le fasi di rilascio del medallion guarantee in coordinamento con le società autorizzate del Regno Unito con cui collabora abitualmente.

Per informazioni e richieste info@studiolegalebottino.it

Avv. Carlo Bottino

Dott.ssa Chiara Guerritore

Gli eredi dello “zio d’America” si trovano ad affrontare un problema di non facile soluzione: come gestire un patrimonio estero non dichiarato dal de cujus ricevuto in eredità.

Le alternative in sostanza erano due

- Mantenere il patrimonio nascosto al fisco, incorrendo nelle violazioni delle norme sul monitoraggio fiscale

- Dichiarare i beni ereditati e versare le imposte non versate dal defunto ratione temporis

A seguito della circolare n. 10/E/2015 dell’Agenzia delle Entrate vengono chiariti alcuno aspetti relativi alla presentazione di una istanza di voluntary disclosure da parte degli eredi, aprendo così una nuova e vantaggiosa possibilità per il fortunato erede dello zio americano.

La convenienza è elevata perché le sanzioni (riferibili al defunto) sono intrasmissibili agli eredi, ma anche perché si può “liberare” l’asse ereditario e impiegarlo come meglio si crede. L’evento di liquidità, come lo chiamano i family office, o comunque il subentro nel possesso di asset, può rappresentare un’occasione per ottimizzarne il passaggio generazionale.

Gli eredi sono tenuti a presentare in via telematica il modello di disclosure sia in nome proprio (se hanno anch’essi violato gli obblighi di monitoraggio, dopo il decesso del de cuius) che per il defunto. In relazione alla posizione di quest’ultimo, c’è l’obbligo di corrispondere unicamente le maggiori imposte sottratte a tassazione, in quanto le sanzioni sono intrasmissibili agli eredi; costoro, invece, con riguardo alla propria posizione, devono pagare sia le imposte che le eventuali sanzioni. Nella relazione accompagnatoria da presentare nei 30 giorni successivi all’istanza vanno dettagliate violazioni e imponibili sia ante che post mortem. In presenza di più eredi, le posizioni di questi ultimi sono intimamente connesse e rientrano nella nozione di “soggetto collegato”.

Esempio pratico

Se le attività estere illecitamente detenute sono state costituite dal de cuius nel 2003 e questi è deceduto a fine 2011, gli eredi dovranno limitarsi a versare tramite la voluntary:

- le sole imposte sui redditi per gli anni ancora accertabili (gli ultimi 5 ) riferite al de cuius (se gli attivi sono white list o black list con accordo, 2010, 2011);;

- le imposte e relative sanzioni sulle violazioni commesse in prima persona dagli stessi eredi dopo il decesso (presumibilmente connesse con la mancata tassazione di redditi finanziari o eventuali canoni di locazione)

le sanzioni relative all’RW non compilato dagli eredi fino al 2011

– l’eventuale imposta di successione (in assenza di franchigie applicabili) e le relative e sanzioni.

In questo caso è possibile ridurre tali sanzioni avvalendosi dell’istituto del ravvedimento operoso ma sarà necessario coinvolgere l’Ufficio impositore.

Il contribuente dovrà presentare la dichiarazione di successione tardiva, e l’Ufficio procederà a liquidare l’imposta dovuta che il contribuente verserà con le sanzioni ridotte da ravvedimento nei 60 giorni.

Avv. Carlo Bottino

Also published in

The Italian legal system, based upon the Civil Law, is characterised by a very high number of laws and a significant variety of grounds for appeal.

It is important to stress that legal proceedings, both civil and criminal, generally last many years.

The necessary legal proceedings are time consuming and will therefore have a direct effect on the process of the debt collection.

Debt collection in Italy requires a title which enables the creditor to commence execution of proceedings. Such titles may be, inter alia, a sentence, a cheque or a bill (of Exchange).

In order to allow the creditor to collect his credit within a relatively short period of time, the Italian Legislator has fixed a short proceeding – which usually lasts a few months – and is followed by a payment injunction issued by the Court which orders the debt to be paid, in addition to interest as well as part of the legal expenses.

In order to obtain the Court’s injunction (Decreto Ingiuntivo), the creditor should provide the Judge with written evidence regarding the debt’s existence: the creditor should, in other words, prove that the goods or the service have been regularly supplied/rendered to the debtor.

When the creditor is a professional, an entrepreneur or a company, the evidence required may also be provided in the form of a copy of the invoices, especially when the debt is related to services rendered.

Starting from the day in which the payment injunction has been formally served to him, the debtor may oppose it within a period of 40 days.

Where no such opposition has been made, the creditor may commence proceedings for the execution of the injunction.

Alternatively should, for any reason, the debtor decide to appeal, a “regular trial” takes place. The main issues discussed in such a trial are the legitimacy of the order (mainly formal aspects), the existence of the debt and whether it is collectable.

It is worthwhile to point out that in order to discourage debtors from filing groundless appeals, having as a unique scope the postponement of payment, the Italian law provides a remedy which seems to be quite efficient: in case the appeal is not based on relevant circumstances proved in writing which have occurred prior to the payment injunction (for example, a written complaint regarding the quality of goods/services), the Court may authorise the creditor to collect his credit without having to attend the end of the trial.

Other titles which enable a creditor to initiate execution are cheques and bills (assegno/cambiale).

In case of their dishonour, the creditor may summon the debtor to pay within 10 days while advising him/her that unless they are paid, execution proceedings shall commence.

The aforesaid proceeding is quite simple, rapid and does not require the Court’s intervention thus leaving the debtor a narrow range of possibilities on which to appeal.

Avv. Carlo Bottino – lawyer in Milano – Founder of Angloitalianlaw

Also published

http://www.studiolegalebottino.it/consulenze-legali/collect-debt-in-italy/

The Italian legal system is very different from the English. Conveyancing is strictly governed by Italian Law and can be performed only by a public notary (Notaio), who is a qualified professional and public officer. Only in front of Notaio it is possible to complete the purchase of any real estate.

THE PRELIMINARY CONTRACT (Contratto preliminare or compromesso)

If you are still happy with the property then the next step is to go ahead with the preliminary contract (compromesso). The compromesso is a significant commitment and involves the payment of a deposit to the seller as an act of good will and undertaking. The purpose of the compromesso is to clarify all the conditions of the sale, including the purchase price and term of payment.

The compromesso can be drawn with the agreement of both parties. It is a golden rule to get a legal advice by an Italian lawyer before signing it. It is very important the buyer not to sign the compomesso unless He is perfectly happy and aware with everything written in the contract. Remember the buyer is in a position to impose conditions or restrictions on the vendor at this stage (e.g. see an example of compromesso conditioned to get planning permission.

The signing of the compromesso which involves both the vendor and the buyer or their power of attorneys must take place in the presence of the notaio. At the time of signing, the buyer must pay a deposit of between 10 and 30 % of the sale price. Should the buyer not to go through with the purchase after signing compromesso, he will lose the deposit paid and may be sued by the vendor. If, however, the deal does not proceed because of the vendor, the buyer has the right to demand up to twice the amount of the deposit paid in compensation. In this case the buyer may also claim damages and have the sale compulsorily completed by a Court order (art. 2932 Italian civil code).

CAPARRA PENITENZIALE

If there is any doubt in the mind of either the buyer or the vendor as to the final completion of the sale, it is possible to state in the compromesso that the deposit is a caparra penitenziale (withdrawable). This will prevent any further legal proceedings or claims for damage. However, in the case of the buyer ‘s breaking contract, he or she will still have to lose the deposit to the vendor, and in the case of the vendor’s withdrawings, he or she will still have to pay double the deposit amount to the buyer.

If both parties want a quick sale and have no differences concernings conditions, price or otherwise, it is possible to have the actual transfer of the property written into the compromesso.

COMPLETION (ATTO)

The atto is the final act, when the Notaio certifies the parties’ identity and witnesses the transfer of title from one party to the other and collects the taxes due on the transaction. With all parties present the notaio will identify them, one by one, and then read through the rogito (completion document) in detail, making sure that everyone understands what is being bought and sold. With all in agreement, the notaio will ask each party to sign before he signs and adds his official stamp to the document. In case of absence of either one of the parties he will certify the signature of the procura speciale (power of attorney). At this moment of the completion the buyer has to pay the remaining balance of the purchase price, plus taxes and notaio fees.

REGISTRATION OF THE TITLE

In Italy there are two different Official Land Registries: the Catasto and The Conservatoria dei Registri Immobiliari. Once the transaction has been completed, the notaio will register the transfer of the title by the vendor to the seller into the Conservatoria Registry; this is very important, should another person registers another atto earlier than you, the other will beat your title and become the new owner.

GOLDEN RULE

Check the vendor’s title before starting with conveyancing in the Conservatoria Registri Immobiliari entering the seller’s name (Italian Lawyers and Notai can do this for you with their dedicated internet access). This is the only way to check the good title and if there are any charges on the property (e.g. mortgages, Court Order, Court Proceedings in course relating to the property etc…) . In the Catasto you can find only the exact id. number of the land without being sure with the name the owner.

Make sure the Conservatoria does not contain any adverse entries at 3 stages: a) Before putting your offer and signing the compromesso b) after signing of the the compromesso c) immediately after the atto.

Avoid the other pitfalls in buying property in Italy (neighborough farmer’s pre-emption right, planning permission denied, regional environmental legislation, geological and sismic reports)

Avv. Carlo Bottino

PUBLISHED ON AMERICAN BAR ASSOCIATION REVIEW

Collaborative Practice in Italy: Statutory Law N. 162/2014

Collaborative Practice in Italy: Statutory Law N. 162/2014

(a.k.a. Negoziazione Assistita)

By Marco Calabrese

Times were ripe for a change in family law in Italy when we set up the first Association for Collaborative Law in December 2009. Once a core group of us learned about Collaborative Practice, we realized it was a step in the direction Italy needed to preserve family relationships during and after divorce. It took us the next few years to set up a small, determined community of practitioners and (it still seems incredible to me) to get a statute on Collaborative Law passed by the Parliament in 2014. While Italian culture is not the same as North American culture and the reasons we have embraced Collaborative Law may not resonate quite the same way on the other side of the Atlantic, our experience might be of interest to North American Collaborative lawyers.

Some of the characteristics of Italian family law that made Collaborative Law such an attraction were:

- 1) Italy is a no fault jurisdiction: a spouse needs no special reason to get a divorce and gets no benefit from claiming that the other spouse was at fault except in very limited circumstances. Accordingly, if the parties agree on a divorce, they do not need to litigate and may apply for a Joint Divorce or Separation Order without assigning fault to anybody. These joint applications comprise over 90% of divorce cases. One party can apply separately as well, without the need of blaming the other party for the breakdown. Negotiation is therefore usually in the best interest of both parties.

- 2) Courts do not divide the assets of the couple when issuing a divorce/separation order, which makes our task incredibly easier than in Anglo-American Countries. In other words, when spouses apply for divorce, all they get from the court is a divorce order, without any reference to separate or marital property. Even if spouses have shared assets, a judge consideration a divorce has no statutory authority to do anything other than ignore them. One of the reasons this works in Italian society is that shared property seldom exists, mainly for tax reasons: developing separate assets over time is a natural result of separate calculations of each spouse’s income in order to reduce taxes. On the rare occasion that the marital house is a shared asset (less than 30% of cases), a further lawsuit must be filed to divide this asset. This lawsuit may be long and expensive, like in property division cases one might bring against a family member or a business partner. We have no such thing as equitable distribution or a “fair” division of assets in an Italian separation or divorce. As a result, one of the main areas of strife in a US divorce process is not something the parties have to negotiate.

- 3) The Court has the authority to decide only three things:

- Matters related to children. The normal decision is shared custody, with the mother acting asthe main caregiver. However, in extreme cases such as those involving domestic violence, the Court may order one spouse be granted sole custody. It is unusual for the father to be the main caregiver of children after divorce, representing only about 3 to 5% of cases.

- Monthly maintenance for the children. In cases in which the wife has limited or no job prospects due to age or other reasons there must be support for the wife, too. While it is not common for the husband to receive support, the statute is gender-neutral.

- Use (as opposed to ownership) of the marital home. Generally, the main caregiver lives with the children in the marital home until the children become [old enough to be] financially independent. After that, the house goes back to the person who is mentioned as owner on the property title: husband, wife, or both of them.

Therefore, on the surface there do not seem to be not very many things to argue about in an Italian

divorce case.

However, people are people. We noticed that, despite the fact that many Consent orders follow such an easy pattern, former spouses were often returning to court for modifications within three or four years. Although the couples declared themselves as having an agreement on the terms of their divorce, many were clearly frustrated by the outcome. The lawyers had a hard time understanding why.

We then realized that the reason was anger and frustration. We thought we had created the most peaceful system for separation and divorce in the world, a system that disincentives litigation and in which there was not much to win if one chooses to litigate. But, frustrated couples will find a way fight anyway, even with a relatively peaceful, ready-made outcome. We also realized that the sort of divorce settlement enshrined in our statute comes from the court or from two lawyers, when what the parties really needed was to talk and find their own solutions.

In 2010, I was discussing the problems we were seeing with friends in London (Family Law in Partnership LTD – Covent Garden), who introduced me to the magic of Collaborative Practice. We then brought Collaborative lawyer Ron Ousky to Rome for an introductory training in the way Collaborative Law worked in other jurisdictions.

The family law bar in Rome was excited. Through the energy of many people, we succeeded in bringing Collaborative Law into Italy faster than any of us could have imagined through the adoption of a statute. Only four years after our first training, Parliament adopted a National Statute on Collaborative Law, which is modeled on the Collaborative Standards of the IACP (International Academy of Collaborative Professionals). There are now tens of thousands of Collaborative divorce cases in Italy every year, with a requirement for mandatory pre-trial ADR for civil cases involving less than 50,000 Euros as well.

Our Statutory Law reads like this.

- The procedure begins with a letter from an Attorney, asking the other party to retain a lawyer for an “Negoziazione Assistita,” an Assisted 4-way Negotiation.

- Since Collaborative Law is voluntary, if the other party agrees to participate there is an initial 4-way meeting at which the participants then sign a participation agreement. The minimum time provided by the law to close the whole negotiation is 30 days; the maximum duration of the procedure is 3 months, extendable to 4 months by agreement of the parties. The strict time limit places pressure on the parties not to get stuck. If the parties do not agree or the case goes on too long, the matter goes to litigation.

- As in North America, the Participation Agreement provides a requirement for mandatory transparency and confidentiality. It also contains a unique touch, a duty of loyalty to the other signatories to the agreement (including between lawyers!): not being loyal during the process can make the final agreement void (as happens in the case where the parties conceal their assets, or income, or hide documents). Both lawyers and clients sign the agreement.

- The Statute does not provide expressly for the “Golden Rule” (that both attorneys must withdraw if negotiation breaks down). It would be redundant. A lawyer who files suit against another party to a contract with whom he or she has signed a confidentiality agreement risks being disbarred under our National Bar Ethical Rules.

- The final settlement must be signed (within the above said timeframe) by the four participants after at least two 4-way meetings. A copy of the settlement must then be filed by the attorneys with the Court’s Archives, where it is rubber stamped. In case of violations of the interests of the children, the District Attorney may oppose to the settlement and recall the parties for a hearing before the Court. To my knowledge this has never happened to date.

- The parties never have to meet with a Judge in order to get the separation/divorce order and the marital settlement approved.The number of Collaborative procedures is rising by the day: we don’t have to struggle to convince the clients or the courts. It is not hard to foresee that in few years the Collaborative Process will mostly replace the litigation process, and court procedures will remain in use only for high conflict personalities.The one minor drawback is that lawyers can always find their way around a statute: some lawyers are using the statutory procedure in a way that undercuts Parliament’s intent. The lawyers negotiate between themselves without signing the participation agreement for fear of losing their clients if a matter has to be litigated, then all the parties meet together and sign the 4-way Participation Agreement. They then wait for 30 more days and meet again for the final settlement. Nobody can tell now how many of the Negoziazione

Assistita each year represent a shortcut, although anecdotal evidence, at least in Rome, is that it is a minority of cases.

You may note one difference between the Italian statute and the way Collaborative Practice is conducted in many jurisdictions: there is no provision for a coach, a mediator, a child expert or a financial neutral. The economics of divorce in Italy do not support this as a mandatory matter; since the litigation alternative is not nearly as expensive as in North America, not everyone would choose to do it. While I do believe that the full Collaborative Team approach is helpful in many cases, clients will not always adopt it voluntarily. As our practice evolves, we will see whether it appeals to more and more clients to use a bigger team. In the meantime, divorcing families in Italy are fortunate enough to have a statutory option.

Marco Calabrese, international family law attorney in Rome, shortlisted by the US Embassy, was the founder and first president of the Italian Institute for Collaborative Law. He acts currently as a Member and a Trainer at “Ronald D. Ousky Collaborative Practice Group.”

We are glad to introduce to you “Anglo Italian Law” the new Alliance of Boutique Law Firms in Rome and Milan. Anglo Italian Law has been founded by Marco Calabrese and Carlo Bottino who have specialised in the field of Family, Civil and Estate Law earning the widespread respect of several institutions for their reliability in helping Clients resolve their financial and family issues. For over three decades we have been committed to helping the International Community with a comprehensive approach, to protect their interest and clarify their rights and to defend them in Court when necessary.